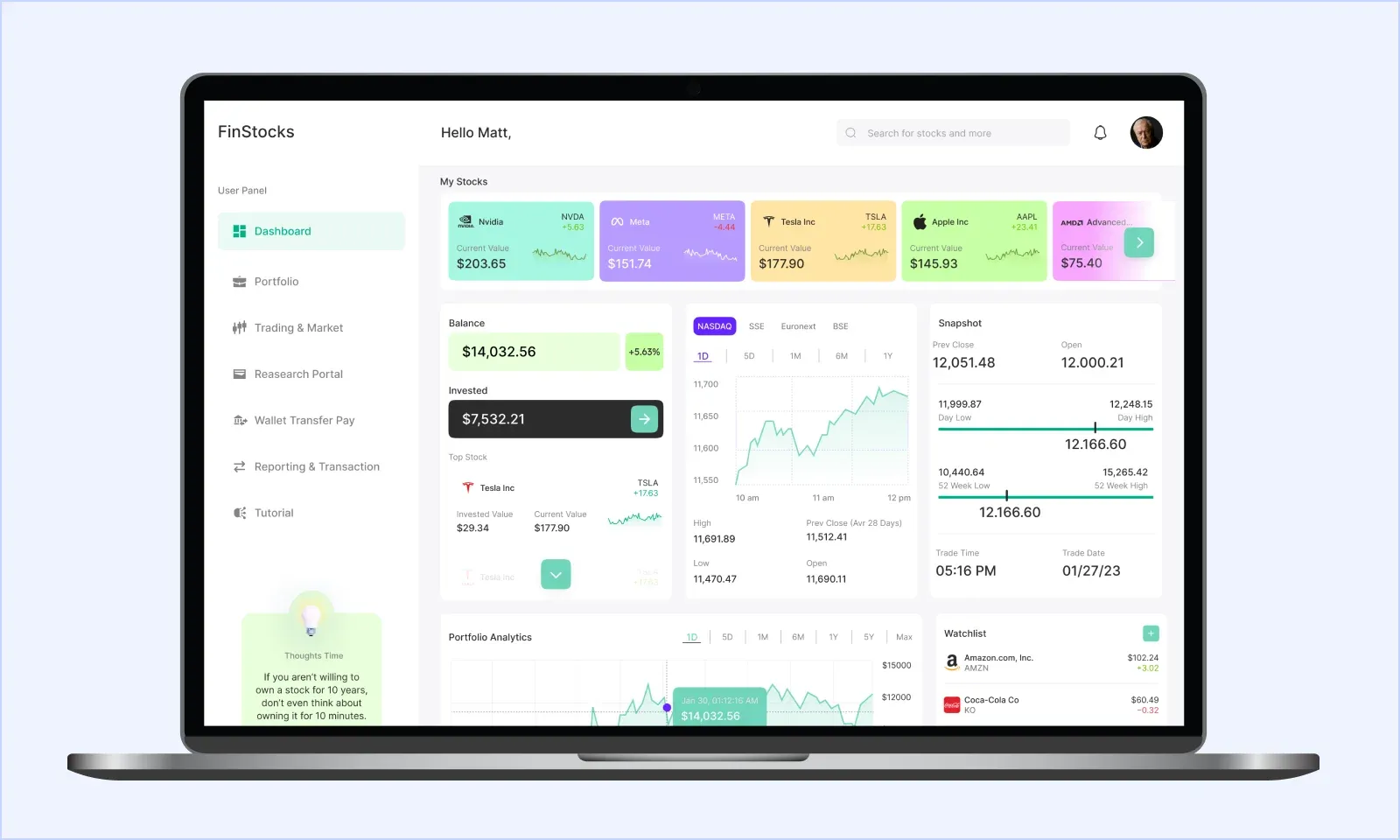

Are you ready to discover the power of trading apps and transform your finances? Let's take a deep dive into the heart of stock trading and unlock the secrets of success. One of the major features that elevate the trading game is the optimized order window design. With lightning-fast deals and expert risk management at customers' fingertips, they can become a trading virtuosos.

Buckle up to unleash your customer's trading and take control of your fintech business!